south dakota excise tax on vehicles

Not in top 12 1. ASRD 6407010102 Rural Water Systems.

ATVs purchased prior to July 1 2016 are exempt from the 4 excise tax.

. Local Vehicle Excise Taxes. By the applicant will be subject to the 4 excise tax as of the date of this documentsubject to law changes If the purchase of the vehicle was within the last 6 months tax will be assessed on the purchase price shown on the provided bill of sale. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. 1 be an enrolled member of a federally recognized Indian tribe. Title fee registration fees excise tax federal excise tax insurance or refundable security deposits on lease number of.

Related

- lanai city hawaii hotels

- paradise cove tanning vienna wv

- Haleigh Breest

- vegan restaurants downtown colorado springs

- food dance kalamazoo reservations

- used tire places near me open today

- root canal done on baby teeth

- george washington carver quotes on race

- how to make a game on scratch 2021

- cousins subs near menomonee falls

If a lessee buys the leased vehicle at the end of the lease excise tax shall be assessed on the purchase prices in 32-5B-4. South Dakota doesnt have income tax so thats why Im using sales tax. There is no inheritance or gift tax in South Dakota so your loved ones will receive all of the money and possessions you leave to them.

The South Dakota excise tax on gasoline is 2200 per gallon lower then 70 of the other 50 states. 35th highest gas tax. 1151 in South Dakota that is governed by the tribe in which you are a member.

Local sales tax does not apply to sales of vehicles. Learn More About Cigarette Tobacco. No excise taxes are not deductible as sales tax.

Several examples of of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and. Plates are not removed from vehicle08 92-House trailer subject to 4 initial registration fee upon initial registration09 94-ATVs purchased prior to July 1 2016 are exempt from the 4 excise tax. Registrations are required within 45 days of the purchase date.

Motor vehicle purchased prior to the June 1985 4 excise tax law or boat purchased prior to July 1 1993 excise tax law. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax. You cant beat 4 excise tax on net purchase of vehicles and RVs.

However some state excise tax is deductible as personal property tax on Schedule A itemized deductions in place of car registration fees. Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32. Motor Vehicles Motor Homes and Mobile Homes - The sale of motor vehicles and motor homes are not subject to sales tax when subject to the South Dakota Registration fee.

Chapter 9-41 Municipal Telephone Systems. Division of Motor Vehicles 445 East Capitol Avenue Pierre SD 57501-3100 1. Motor vehicle excise tax.

Motor vehicle was on a licensed motor vehicle dealers inventory as of May 30 1985. South Dakota assesses the one-time 4 tax if you have not paid at least that much to another state on all vehicles EXCEPT a purchase of a vehicle over 11 years old for an amount less than 2200. If I paid Excise tax on a new vehicle in South Dakota can I claim that as sales tax.

Mobile homes or manufactured HUD homes are subject to a 4 ini- tial registration fee and are exempt from sales use and con- tractors excise tax. Contractors Excise Tax Any person entering into a contract for construction services as defined in Division C of the Standard Industrial Classification Manual of 1987 or engaging in services that include the construction building installation or repair of a fixture to real property must have a South Dakota contractors tax license. You can find these fees further down on the page.

The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. Dealers are required to collect the state sales tax and any applicable municipal sales tax municipal gross receipts tax and tourism tax on any vehicle product or service they sell that is subject to sales tax in South Dakota. For you folks who are from the East Coast what South Dakota calls an Excise Tax is NOT what you are used to.

Vehicles that have not been titled or registered in the US. Chapter 10-35 Electric Heating Power Water Gas Companies. Owning a car can be rather expensive from the point of buying it.

Find information on which cigarettes are allowed to be sold in South Dakota. Mobile Manufactured homes are subject to the 4 initial registration fee. AND 2 reside on Indian country as defined by 18 USC.

Vehicle Excise Tax Rates On A Car In South Dakota. Dealers are not required to collect or pay the motor vehicle excise tax on motor vehicles they sell. All fees are assessed from purchase date regardless of when an applicant applies for title and registration.

Lease Payment includes all capitalized costs but does not include. Supports suppliers distributors and traders dealing with indirect excise taxes. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees.

Order stamps pay excise tax find retailer information and report sales of tobacco products to businesses located within special jurisdictions. Instead a local vehicle excise tax may. The lessor shall assign the title to the lessee and shall deliver it.

To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must. If additional consideration is paid during the course of the lease or upon the termination of the lease the motor vehicle excise tax shall be assessed upon such amount and paid by the lessor. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

South Dakota Vehicle Excise Tax Explained. Like most states South Dakota charges excise taxes on cars purchased. The South Dakota gas tax is included in the pump price at all gas stations in South Dakota.

95-A title only is issued when the applicant does not purchase license plates or pay the 4 excise tax. House trailer subject to 4 initial registration fee upon initial registration. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

South Dakotas excise tax on gasoline is ranked 35 out of the 50 states. 84-Insurance company titles vehicleboat and does not pay 4 excise tax. However if purchased by an out of state business you will need to show proof of tax paid to your local Department of Revenue office.

Chapter 10-36 Rural Electric Companies. How Much Is Excise Tax On A Car In South Dakota. Chapter 10-33 Telephone Companies including Rural Telephone Companies.

Sales Tax On Cars And Vehicles In South Dakota

Ultimate Excise Tax Guide Definition Examples State Vs Federal

1928 Chrysler Imperial Series 80 Chrysler Imperial Chrysler Imperial

Car Tax By State Usa Manual Car Sales Tax Calculator

Purchase Order Forms Check More At Https Nationalgriefawarenessda Contract Template Certificate Of Participation Template Certificate Of Achievement Template

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd Fill Out And Sign Printable Pdf Template Signnow

Contractor S Excise Tax South Dakota Department Of Revenue

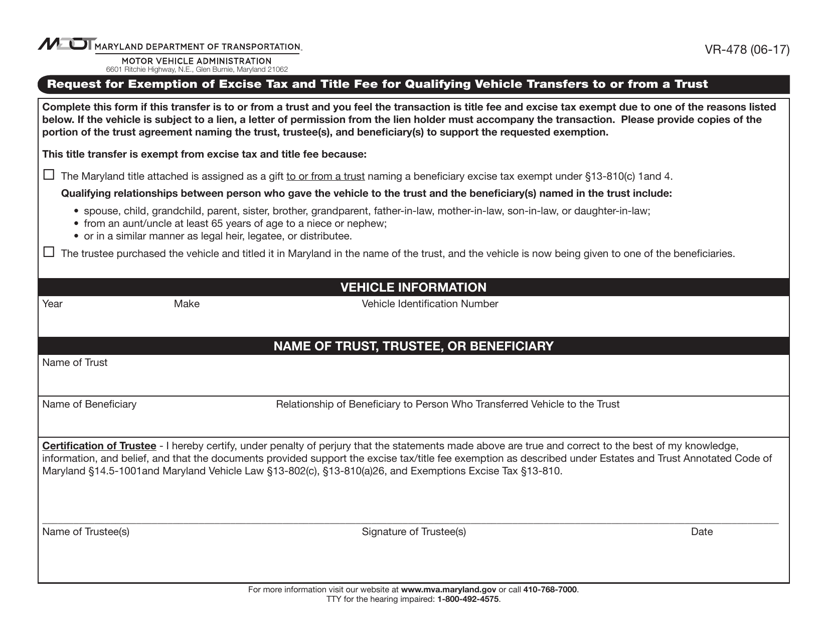

Form Vr 478 Download Fillable Pdf Or Fill Online Request For Exemption Of Excise Tax And Title Fee For Qualifying Vehicle Transfers To Or From A Trust Maryland Templateroller

South Dakota Farmer S Use Tax Form Download Printable Pdf Templateroller

Contractors Excise Tax Webinar Youtube

Individual Faqs South Dakota Department Of Revenue

Bernie Fuchs Art Google Search Automobile Advertising Classic Cars Muscle Mopar

Motor Vehicles Sales Amp Repair State Of South Dakota